Red or Blue?

Red or Blue?

Red or Blue?

June 26, 2024

June 26, 2024

June 26, 2024

June 26, 2024

Election Year

Navigating Market Volatility Through Political Cycles

In recent years, the political landscape has become a significant driver of market sentiment, with elections causing substantial speculation and sometimes leading investors to make emotionally charged decisions. However, historical data underscores the importance of maintaining a politically agnostic investment strategy and focusing on potential policies rather than partisan outcomes.

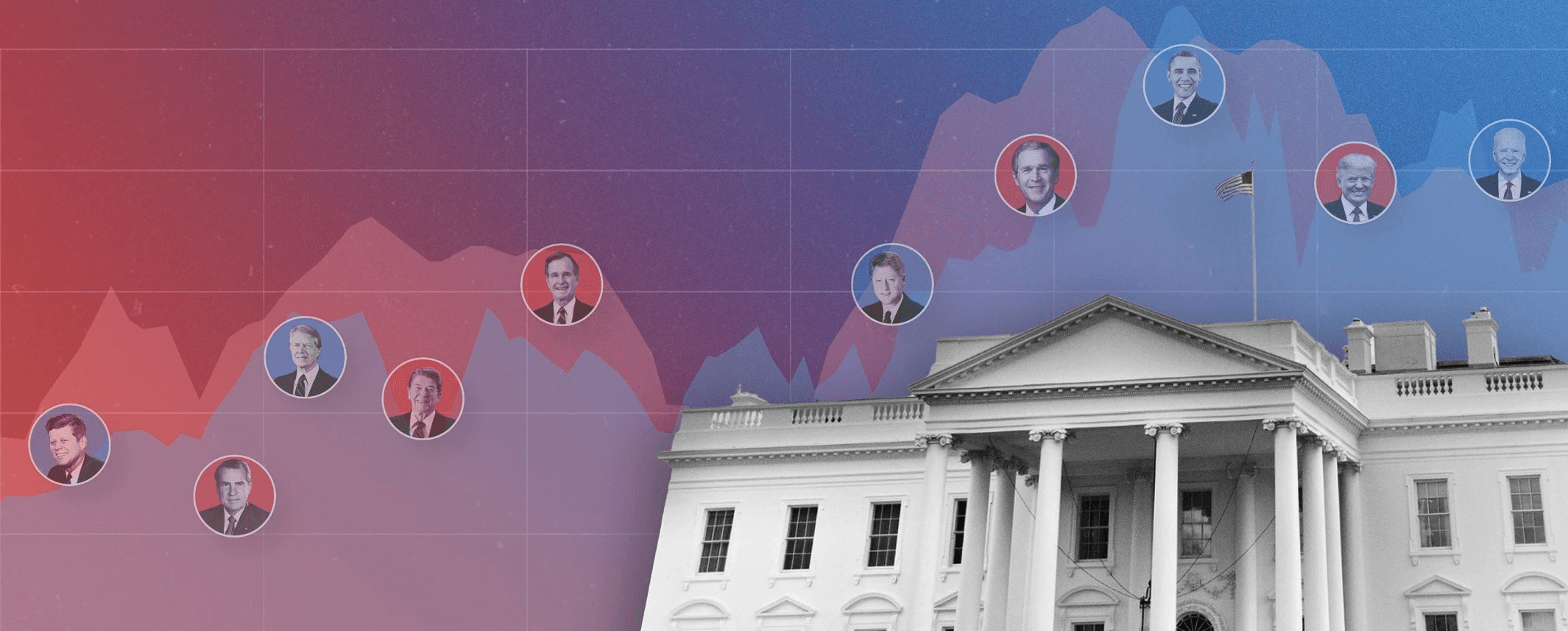

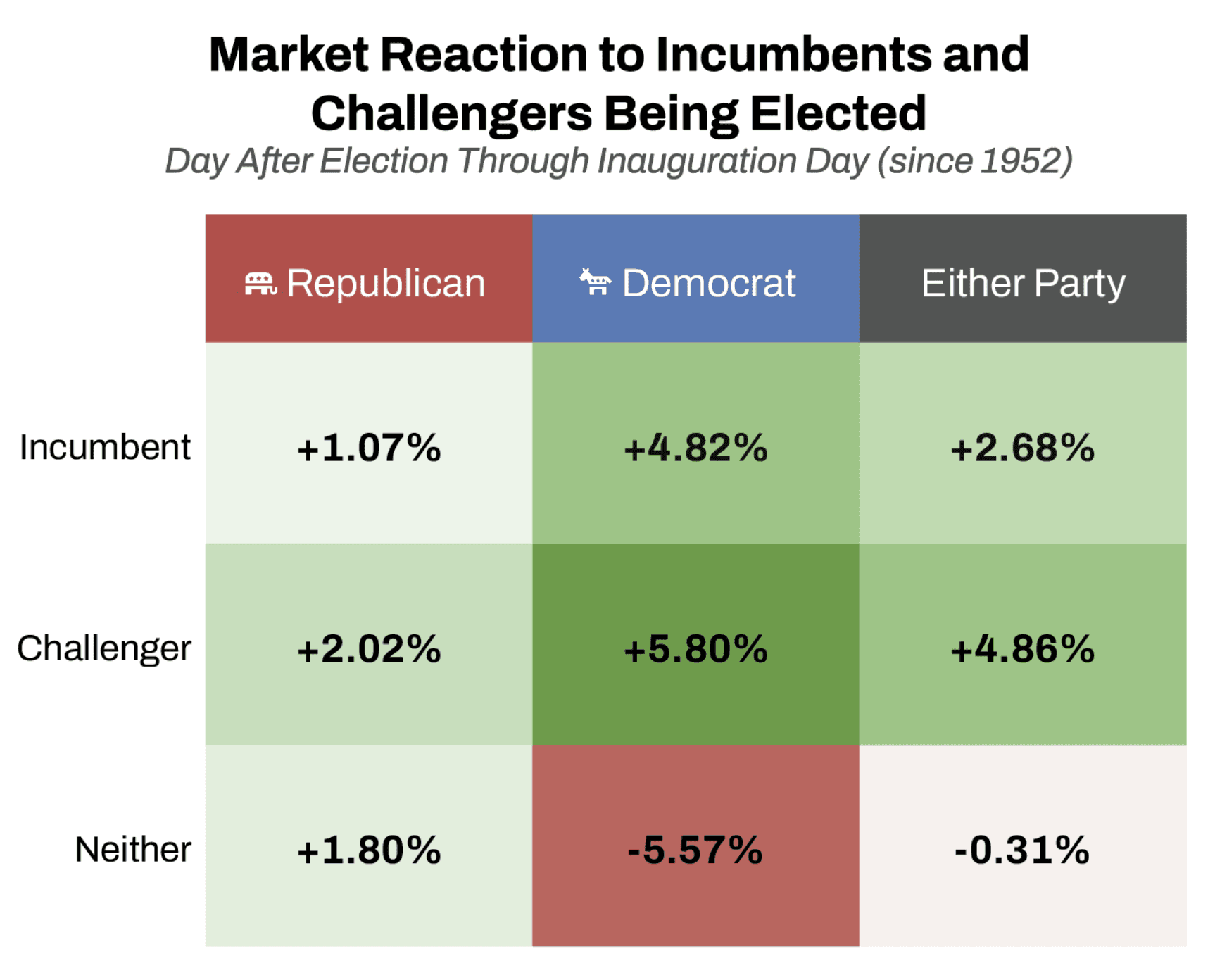

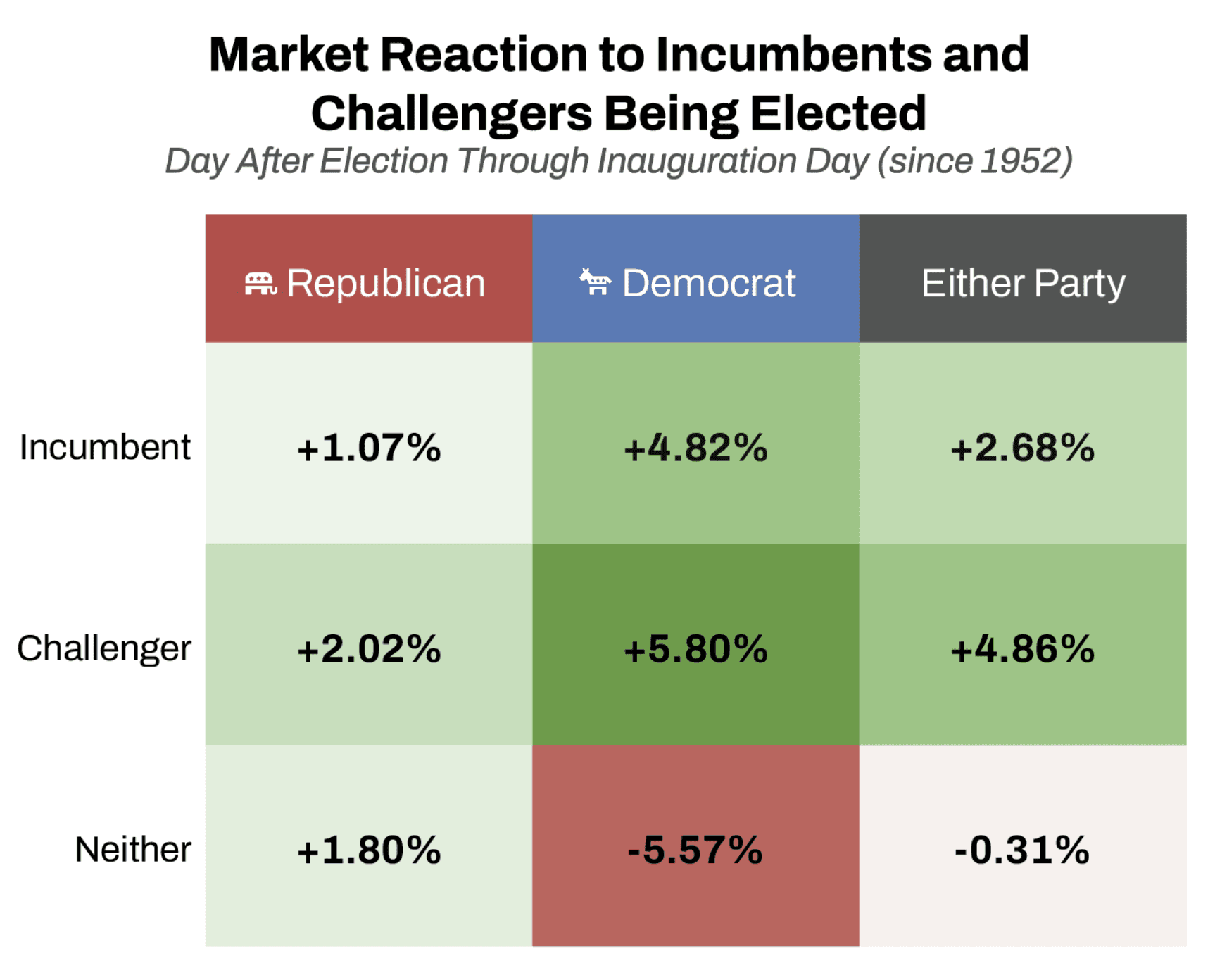

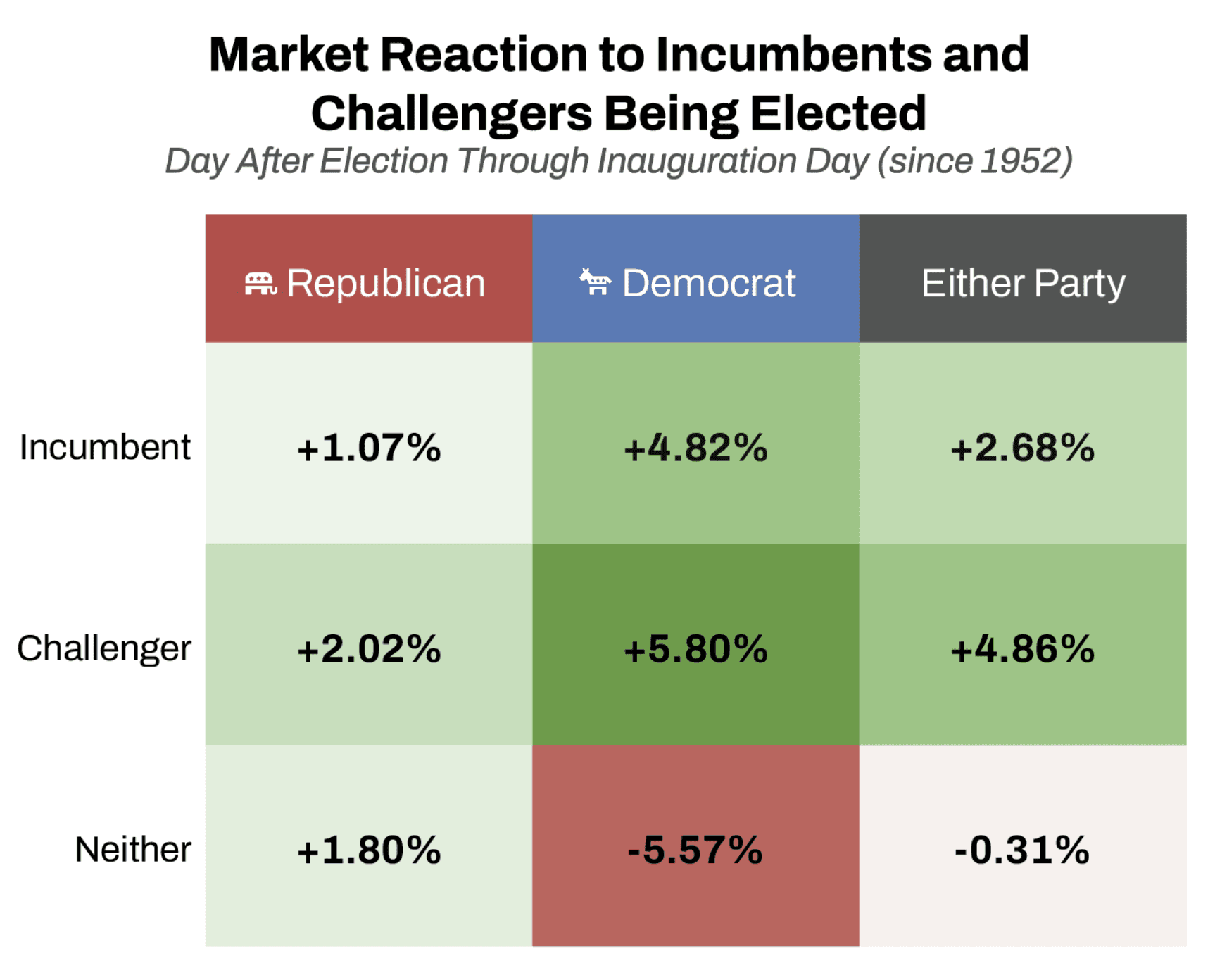

As the following chart illustrates, the market reacts differently depending on the political scenario, whether it's an incumbent being re-elected, a challenger coming to power, or neither candidate having a strong foothold. Markets tend to respond positively when a challenger is elected, with a higher increase of across the board, hinting that regime changes tend to usually favor financial markets. Conversely, if neither party has a strong influence, the market reaction can be negative. This can be expected, after all, Wall Street doesn't like uncertainty.

Does Presidency Matter?

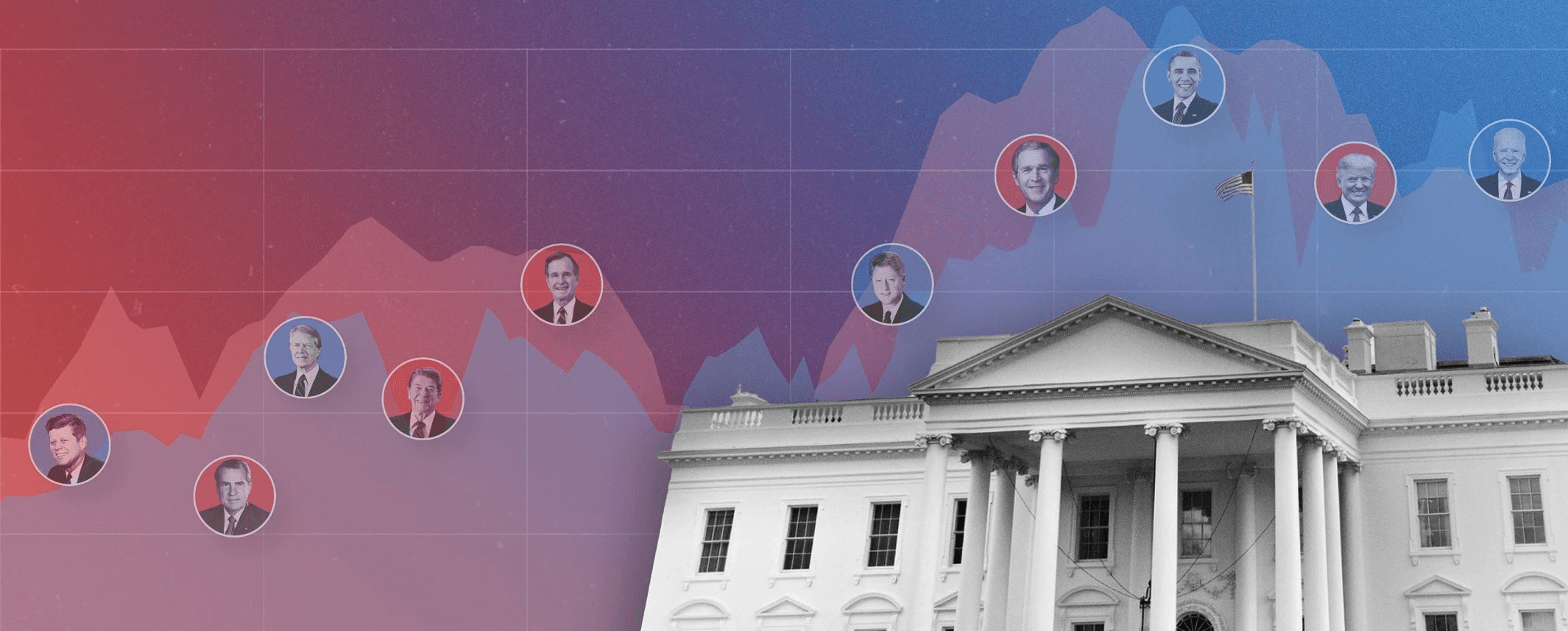

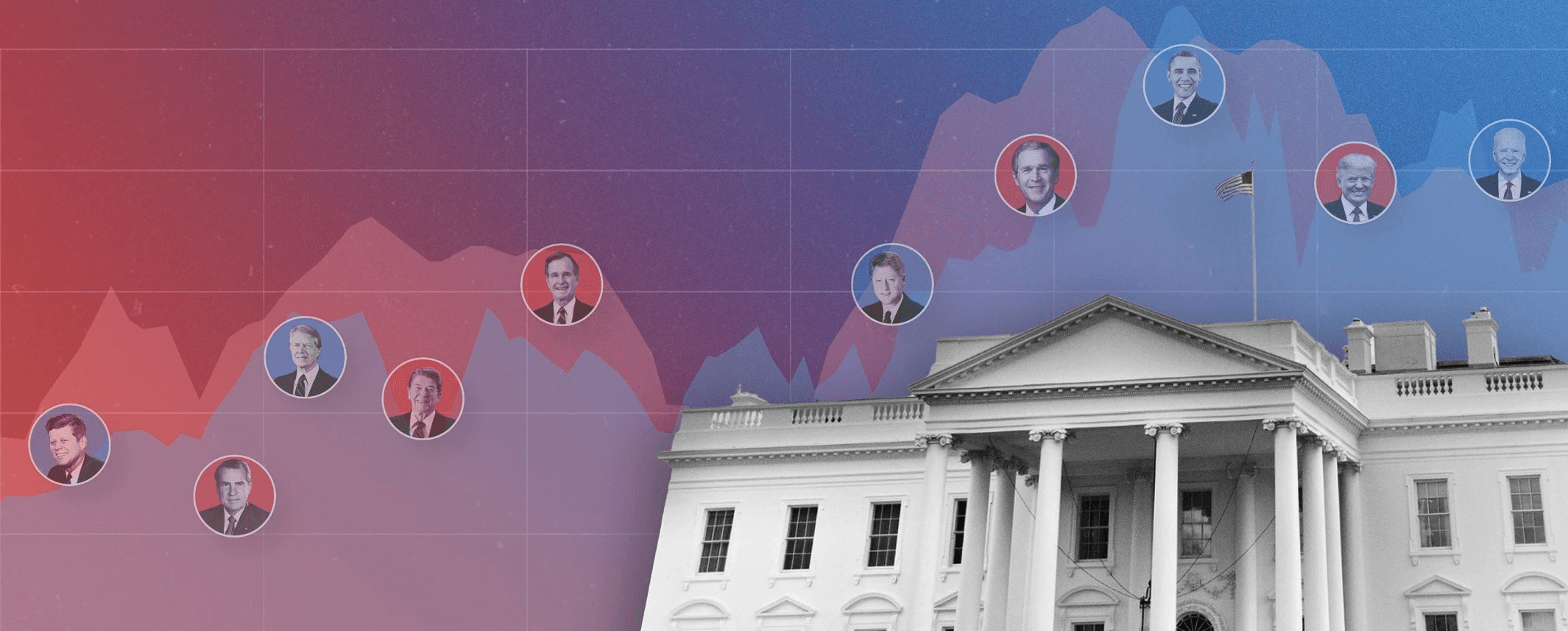

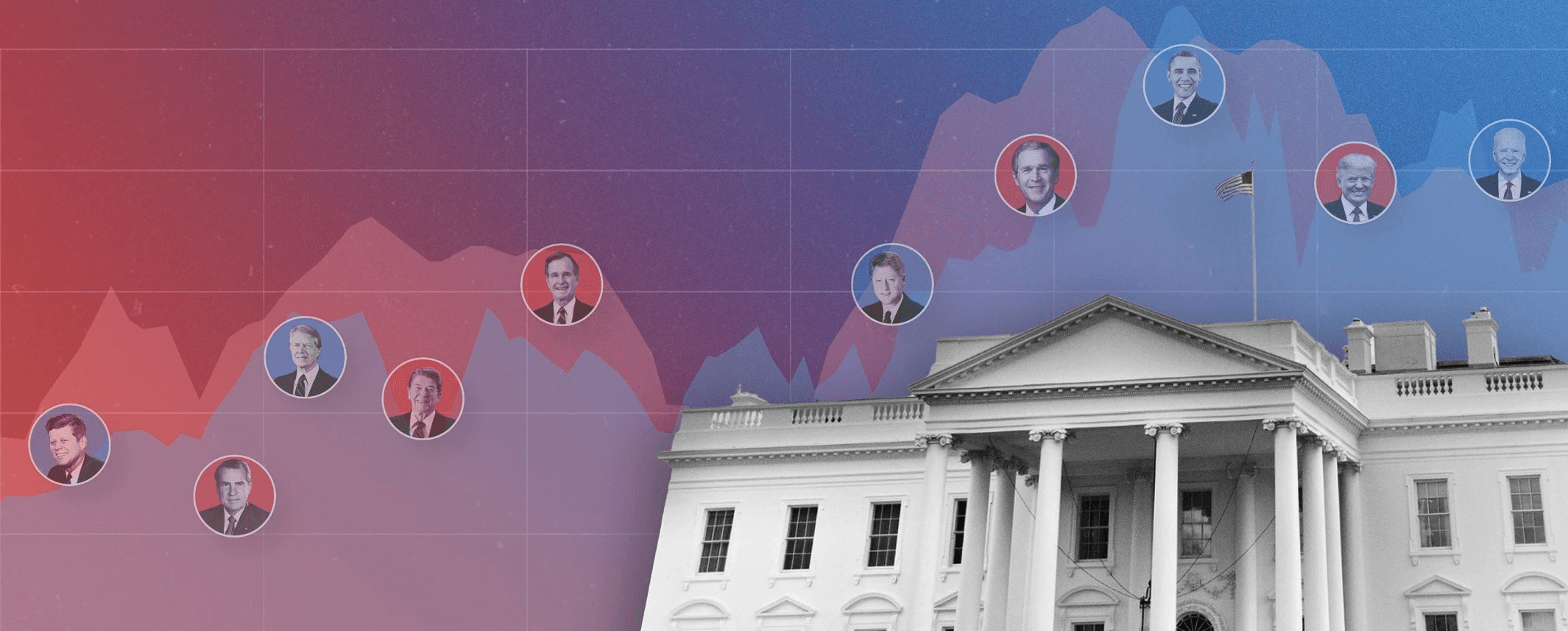

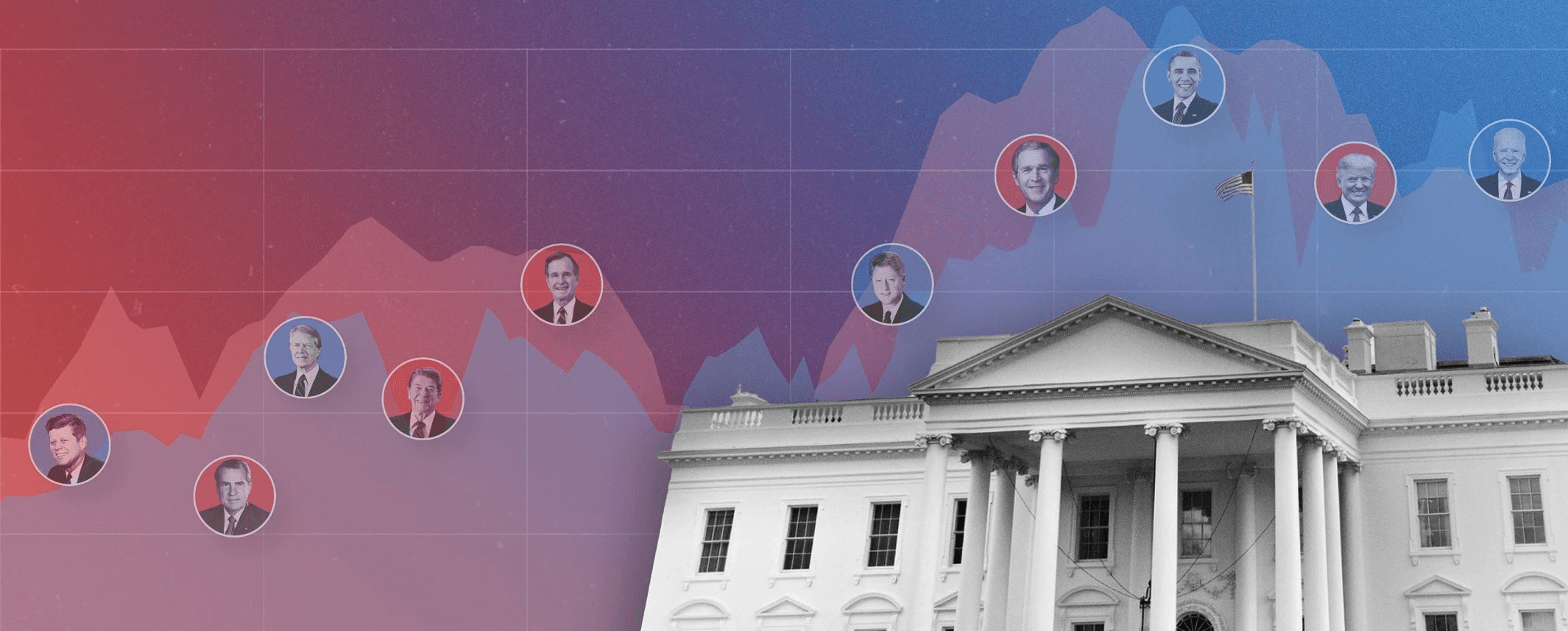

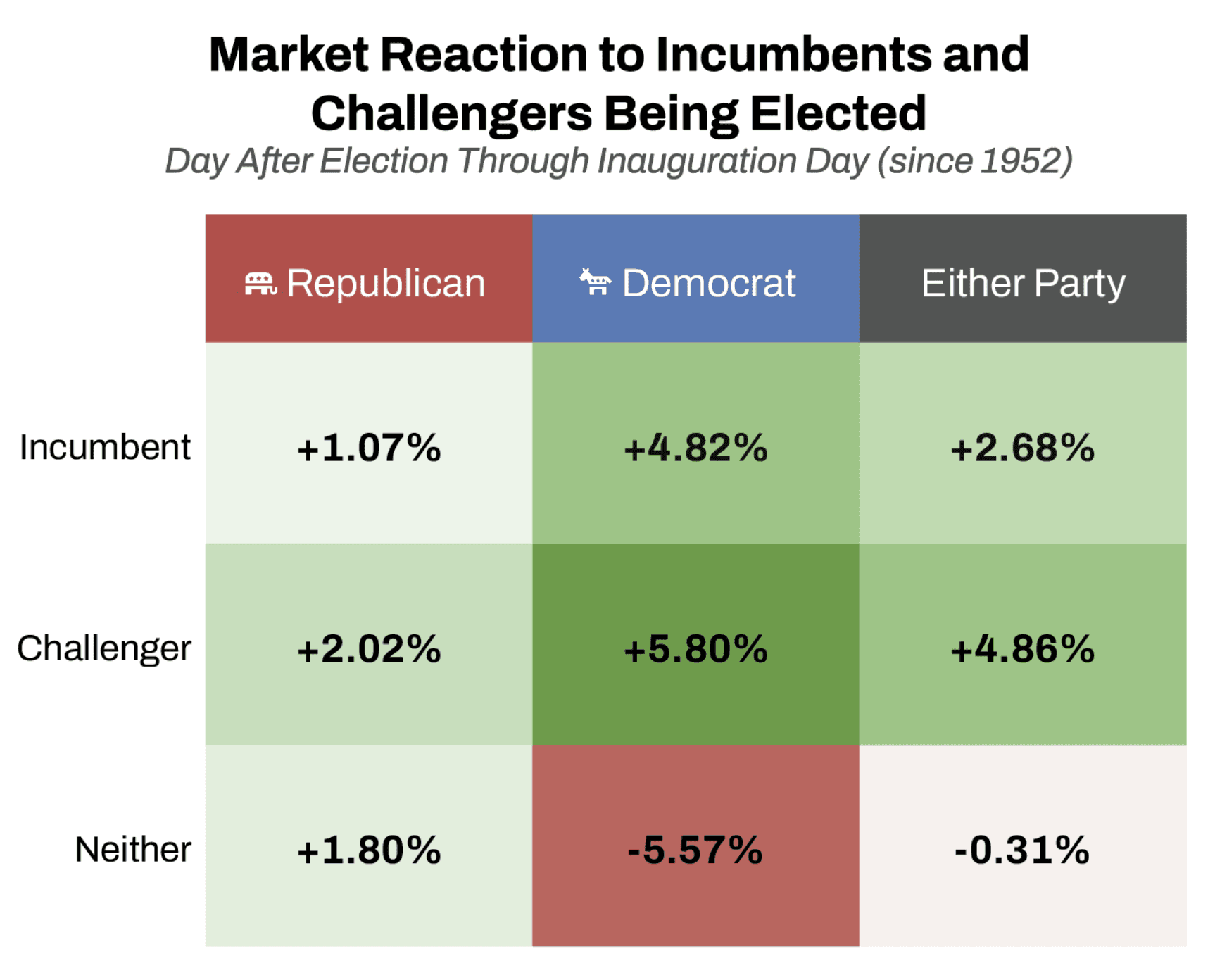

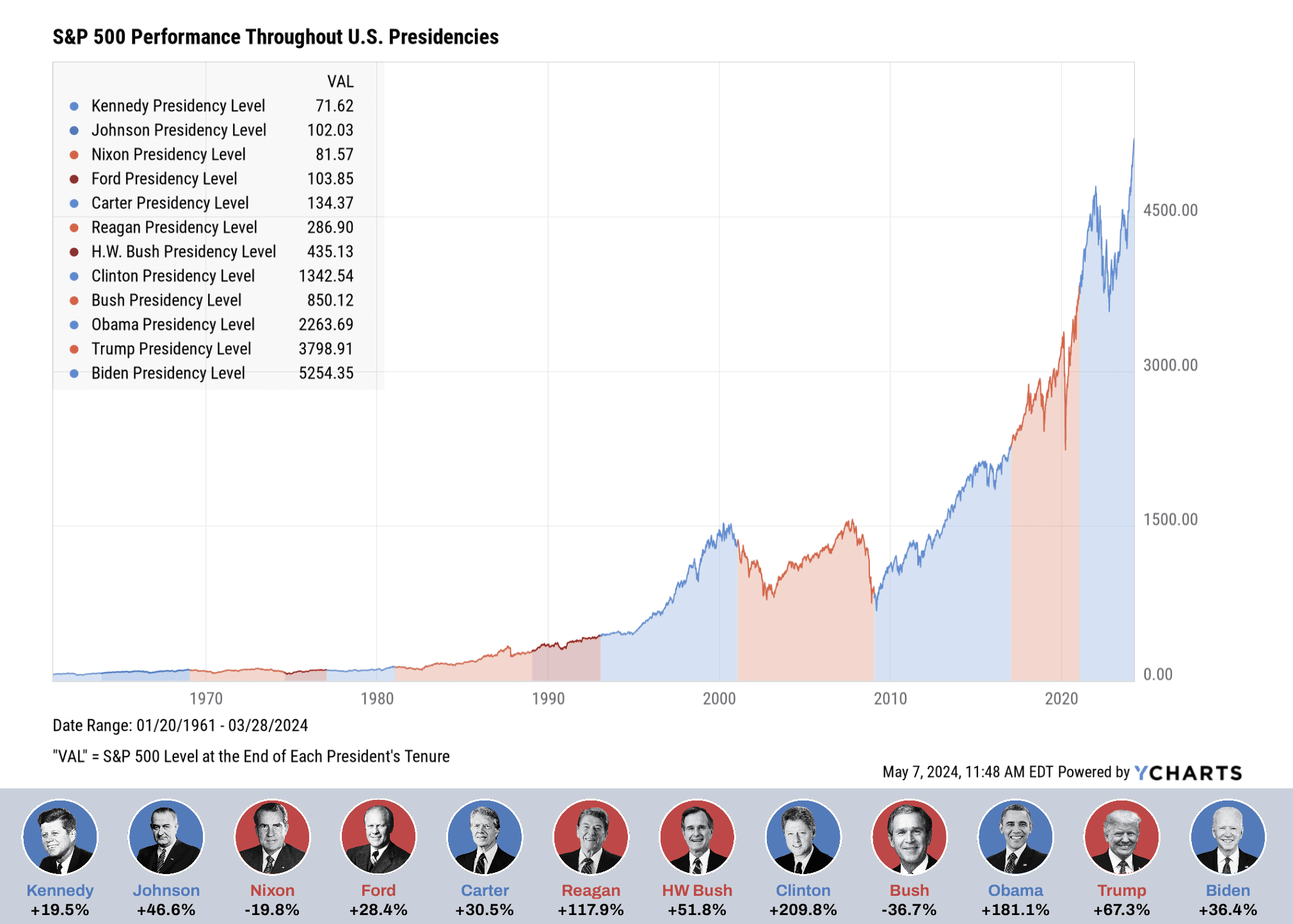

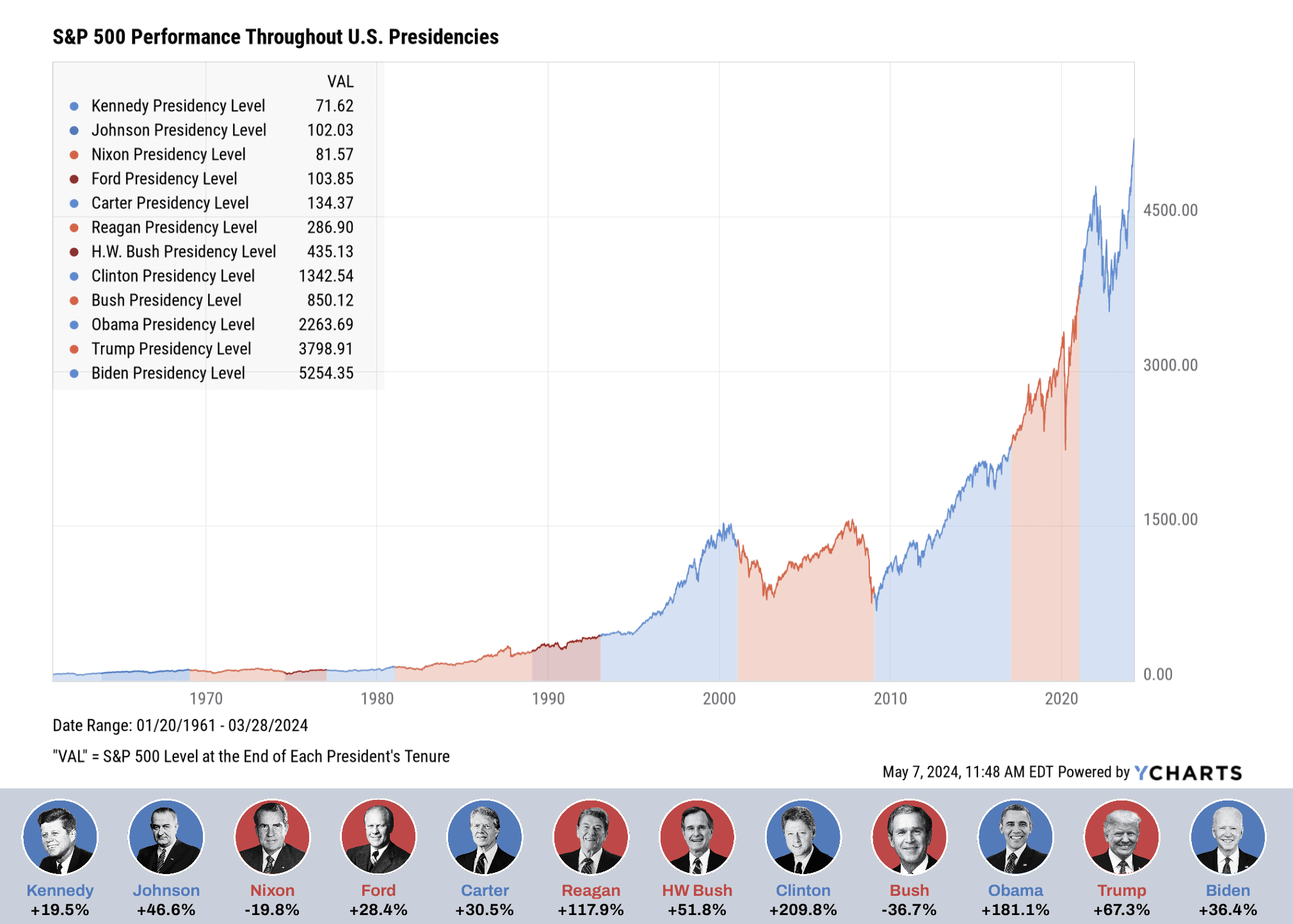

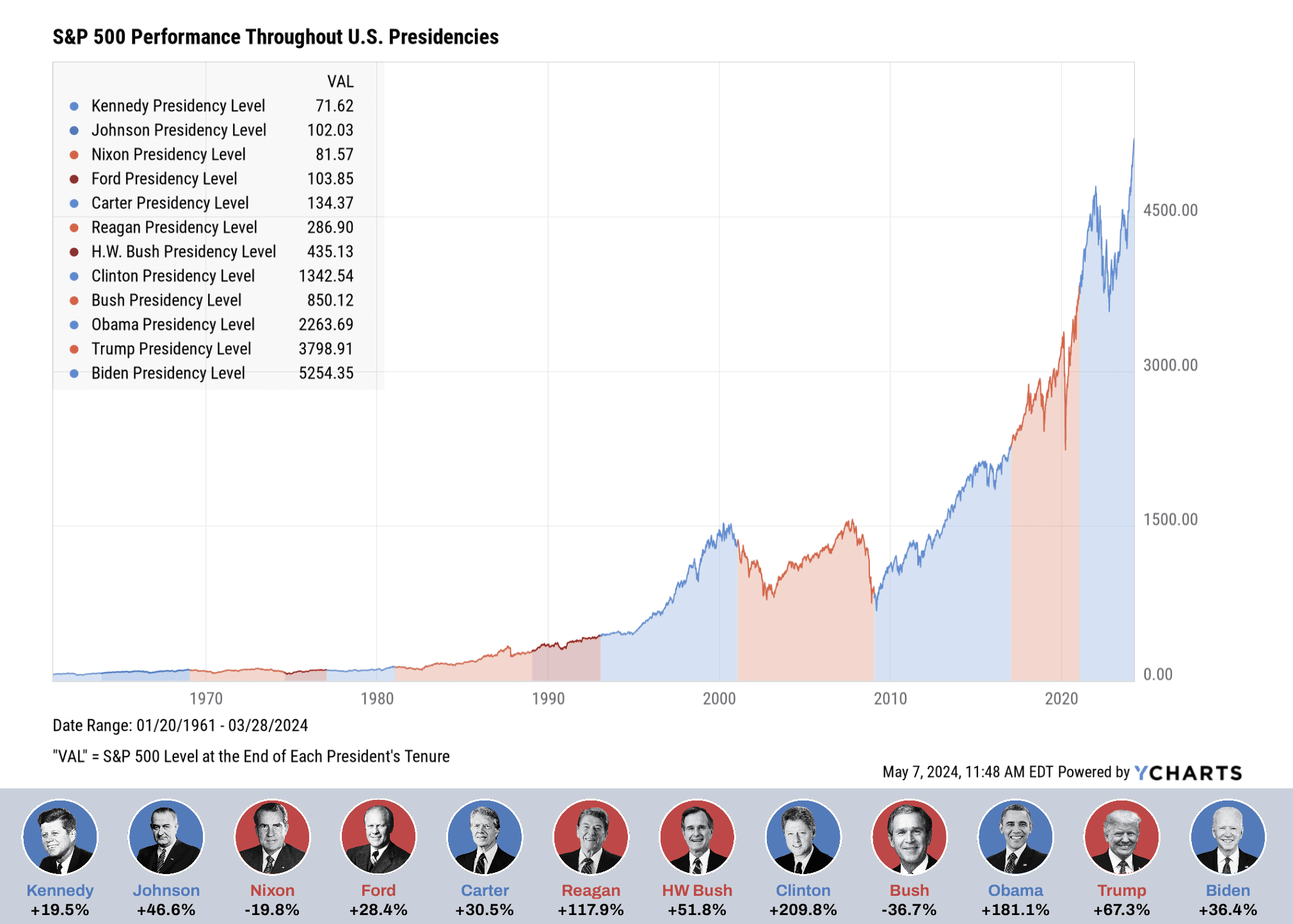

The below chart details the performance of the S&P 500 throughout various U.S. presidencies, showcasing the broad trend of market growth irrespective of the party in power. Notably, the market has seen significant gains under both Democratic and Republican administrations.

Investing with a Forward-Looking Perspective

Investing is much like professional hockey—what separates the pros from the amateurs is their ability to anticipate future movements rather than react to past events. As the legendary Wayne Gretzky said, "Skate to where the puck is going, not where it has been." Similarly, successful investors focus on where the market is headed based on anticipated policies and economic fundamentals rather than getting bogged down by political biases.

Policy Over Politics

At Red Night Capital, our investment strategy revolves around analyzing potential policy impacts rather than aligning with any political ideology. This approach ensures that we remain adaptable and ready to capitalize on opportunities regardless of which party holds office. For instance, infrastructure spending, tax reforms, and regulatory changes can all create investment opportunities that transcend partisan lines.

Navigating Market Volatility Through Political Cycles

In recent years, the political landscape has become a significant driver of market sentiment, with elections causing substantial speculation and sometimes leading investors to make emotionally charged decisions. However, historical data underscores the importance of maintaining a politically agnostic investment strategy and focusing on potential policies rather than partisan outcomes.

As the following chart illustrates, the market reacts differently depending on the political scenario, whether it's an incumbent being re-elected, a challenger coming to power, or neither candidate having a strong foothold. Markets tend to respond positively when a challenger is elected, with a higher increase of across the board, hinting that regime changes tend to usually favor financial markets. Conversely, if neither party has a strong influence, the market reaction can be negative. This can be expected, after all, Wall Street doesn't like uncertainty.

Does Presidency Matter?

The below chart details the performance of the S&P 500 throughout various U.S. presidencies, showcasing the broad trend of market growth irrespective of the party in power. Notably, the market has seen significant gains under both Democratic and Republican administrations.

Investing with a Forward-Looking Perspective

Investing is much like professional hockey—what separates the pros from the amateurs is their ability to anticipate future movements rather than react to past events. As the legendary Wayne Gretzky said, "Skate to where the puck is going, not where it has been." Similarly, successful investors focus on where the market is headed based on anticipated policies and economic fundamentals rather than getting bogged down by political biases.

Policy Over Politics

At Red Night Capital, our investment strategy revolves around analyzing potential policy impacts rather than aligning with any political ideology. This approach ensures that we remain adaptable and ready to capitalize on opportunities regardless of which party holds office. For instance, infrastructure spending, tax reforms, and regulatory changes can all create investment opportunities that transcend partisan lines.

Navigating Market Volatility Through Political Cycles

In recent years, the political landscape has become a significant driver of market sentiment, with elections causing substantial speculation and sometimes leading investors to make emotionally charged decisions. However, historical data underscores the importance of maintaining a politically agnostic investment strategy and focusing on potential policies rather than partisan outcomes.

As the following chart illustrates, the market reacts differently depending on the political scenario, whether it's an incumbent being re-elected, a challenger coming to power, or neither candidate having a strong foothold. Markets tend to respond positively when a challenger is elected, with a higher increase of across the board, hinting that regime changes tend to usually favor financial markets. Conversely, if neither party has a strong influence, the market reaction can be negative. This can be expected, after all, Wall Street doesn't like uncertainty.

Does Presidency Matter?

The below chart details the performance of the S&P 500 throughout various U.S. presidencies, showcasing the broad trend of market growth irrespective of the party in power. Notably, the market has seen significant gains under both Democratic and Republican administrations.

Investing with a Forward-Looking Perspective

Investing is much like professional hockey—what separates the pros from the amateurs is their ability to anticipate future movements rather than react to past events. As the legendary Wayne Gretzky said, "Skate to where the puck is going, not where it has been." Similarly, successful investors focus on where the market is headed based on anticipated policies and economic fundamentals rather than getting bogged down by political biases.

Policy Over Politics

At Red Night Capital, our investment strategy revolves around analyzing potential policy impacts rather than aligning with any political ideology. This approach ensures that we remain adaptable and ready to capitalize on opportunities regardless of which party holds office. For instance, infrastructure spending, tax reforms, and regulatory changes can all create investment opportunities that transcend partisan lines.

Navigating Market Volatility Through Political Cycles

In recent years, the political landscape has become a significant driver of market sentiment, with elections causing substantial speculation and sometimes leading investors to make emotionally charged decisions. However, historical data underscores the importance of maintaining a politically agnostic investment strategy and focusing on potential policies rather than partisan outcomes.

As the following chart illustrates, the market reacts differently depending on the political scenario, whether it's an incumbent being re-elected, a challenger coming to power, or neither candidate having a strong foothold. Markets tend to respond positively when a challenger is elected, with a higher increase of across the board, hinting that regime changes tend to usually favor financial markets. Conversely, if neither party has a strong influence, the market reaction can be negative. This can be expected, after all, Wall Street doesn't like uncertainty.

Does Presidency Matter?

The below chart details the performance of the S&P 500 throughout various U.S. presidencies, showcasing the broad trend of market growth irrespective of the party in power. Notably, the market has seen significant gains under both Democratic and Republican administrations.

Investing with a Forward-Looking Perspective

Investing is much like professional hockey—what separates the pros from the amateurs is their ability to anticipate future movements rather than react to past events. As the legendary Wayne Gretzky said, "Skate to where the puck is going, not where it has been." Similarly, successful investors focus on where the market is headed based on anticipated policies and economic fundamentals rather than getting bogged down by political biases.

Policy Over Politics

At Red Night Capital, our investment strategy revolves around analyzing potential policy impacts rather than aligning with any political ideology. This approach ensures that we remain adaptable and ready to capitalize on opportunities regardless of which party holds office. For instance, infrastructure spending, tax reforms, and regulatory changes can all create investment opportunities that transcend partisan lines.

Latest posts

RNC

Jun 26, 2024

RNC

Jun 26, 2024

RNC

Jun 26, 2024

RNC

Jun 26, 2024

RNC

May 1, 2024

RNC

May 1, 2024

RNC

May 1, 2024

RNC

May 1, 2024

RNC

May 1, 2024

RNC

May 1, 2024

RNC

May 1, 2024

RNC

May 1, 2024

RNC

Feb 10, 2024

RNC

Feb 10, 2024

RNC

Feb 10, 2024

RNC

Feb 10, 2024

RNC

Jan 20, 2024

RNC

Jan 20, 2024

RNC

Jan 20, 2024

RNC

Jan 20, 2024

RNC

Jan 14, 2024

RNC

Jan 14, 2024

RNC

Jan 14, 2024

RNC

Jan 14, 2024

Let’s Work Together 👋

Copright © 2024 Red Night Capital, LLC. All rights reserved.

Let’s Work Together 👋

Copright © 2024 Red Night Capital, LLC. All rights reserved.

Let’s Work Together 👋

Copright © 2024 Red Night Capital, LLC. All rights reserved.

Let’s Work Together 👋

Copright © 2024 Red Night Capital, LLC. All rights reserved.